Blog

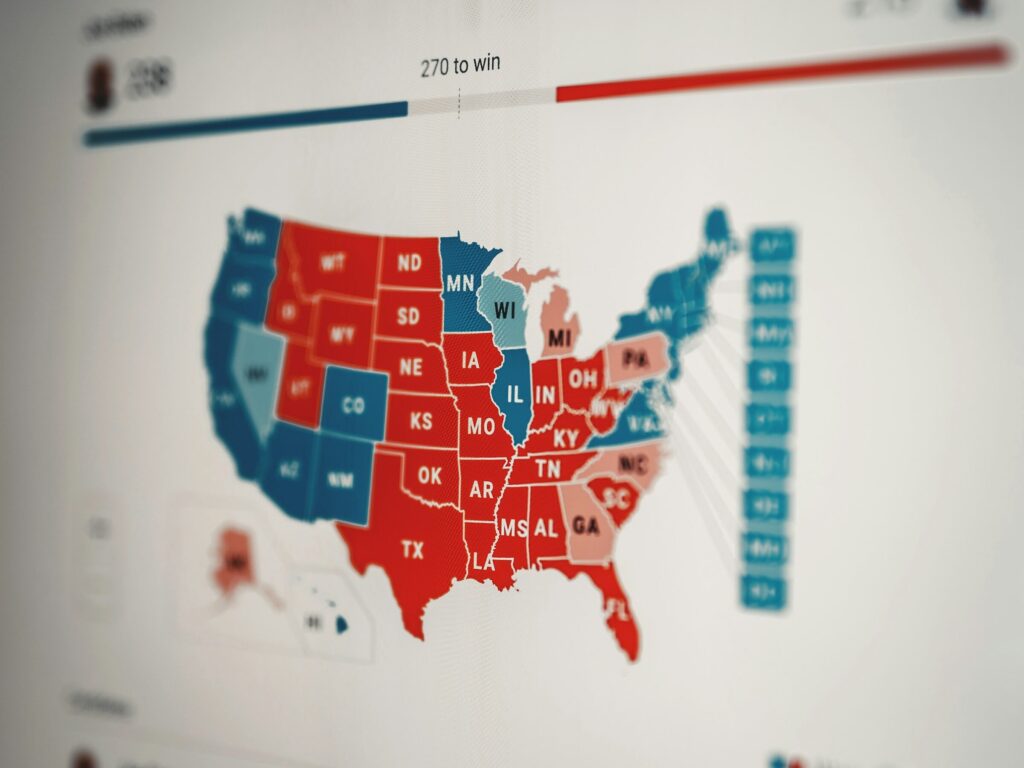

US Election

US politics and election season tends to introduce volatility and uncertainty, both to the upside and downside, especially in the short term.

November 5, 2024

US politics and election season tends to introduce volatility and uncertainty, both to the upside and downside, especially in the short term.

I would not be surprised if we see that over the coming days and weeks.

I would be more surprised if markets stayed calm.

Remember that in the last two US elections, markets went for a significant run to the upside to the end of the year.

Is that going to happen here? Not necessarily.

History can help guide us, but it doesn’t always repeat itself, especially in financial markets.

Often we are surprised by markets, and they don’t do what we think they are going to do.

The world is unpredictable and Black Swan events shock financial markets every so often.

But we can also see surprises to the upside. We saw that in 2020 when a COVID vaccine was announced shortly after the election and a Democrat and Biden victory, and markets took off to the upside.

And the markets in 2016 took a Republican Trump victory as a positive a made a swift move to the upside.

So trying to predict what is going to happen here is not what we are going to do.

Remember that markets have run up over the last 3 months and have moved into overbought or overextended territory.

In 2016 and 2020, markets had sold off and were in oversold territory heading into the November election.

70% of the time, markets are good and healthy and go up. 30% of the time, they are more volatile and go down. We want to be ready for anything.

A realistic view of the markets, economy, and world is what produces the best outcome for you.

We believe in combining fundamentals—what to buy, always focusing on high-quality businesses—with technicals, which guide when to buy, hold, and, most importantly, when to sell.

We want to participate and be invested in the good times and capitalize when markets are strong.

Inevitably, there will be market pullbacks, corrections and crashes, and we want to help you do a better job of navigating the downside and uncertainty when markets are weak.

We take a different approach to navigating markets because we want a better outcome and bottom-line results for you.