Podcast

Red Light Signal

Will Simpson

November 1, 2024

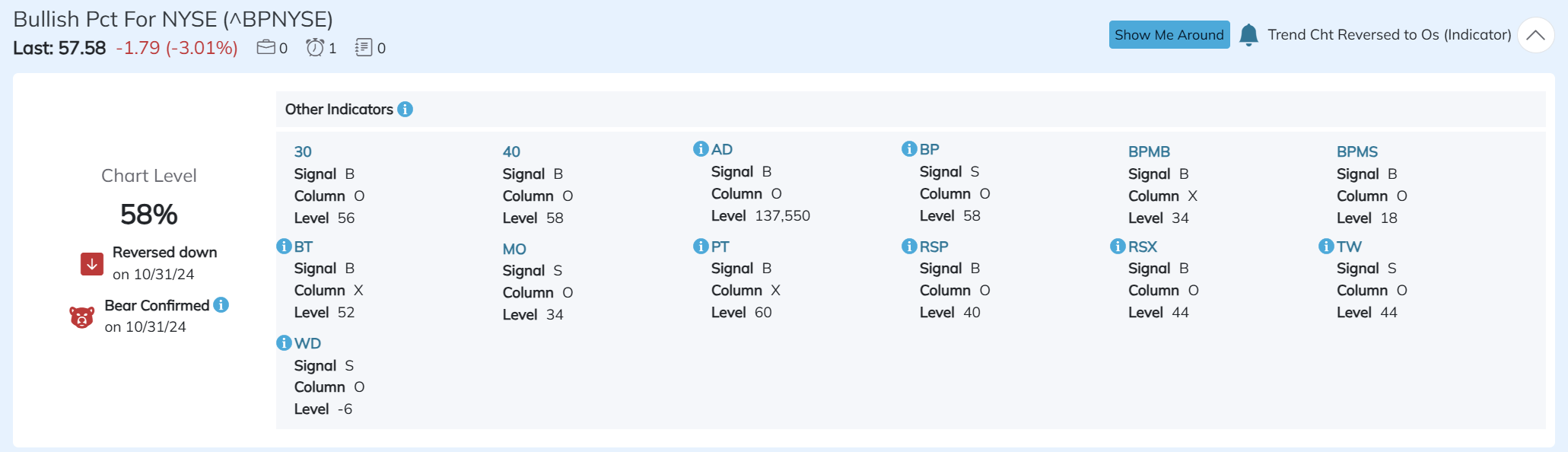

Markets have gone straight up, unchecked for 3 months since early August and have moved into overbought territory.

Our signals have now reversed down, suggesting that it is time to play defence. Does that mean the market is going to go down? No, not necessarily.

But it does mean that risk is elevated right now.

That’s why at Aretec, we shift our portfolio from offence to defence, based on changing market conditions. We move our Tactical Wealth Portfolio from green light to yellow light to red light.

We have a more dynamic approach to navigating markets than the vast majority of advisors. It allows us to better manage risks and also be more opportunistic.

We are active and tactical as opposed to taking a passive buy-and-hold approach.

We will move a portfolio from offence to defence, based on changing market conditions. It’s a green light, yellow light, red light approach to investing.

In our Tactical Wealth Portfolio, we will go to cash.

And we will go to 100% equities. And everything in between, based on risks, opportunities and the environment.

If you would like to discuss your portfolio, the markets and your investment strategy please reach out, we are here working for you.

Best,

Will Simpson, CIM

President, Chief Investment Officer & Portfolio Manager